flow through entity irs

Flow-through entity tax For tax years beginning on and after Jan. Flow-through entities are used for several reasons including tax advantages.

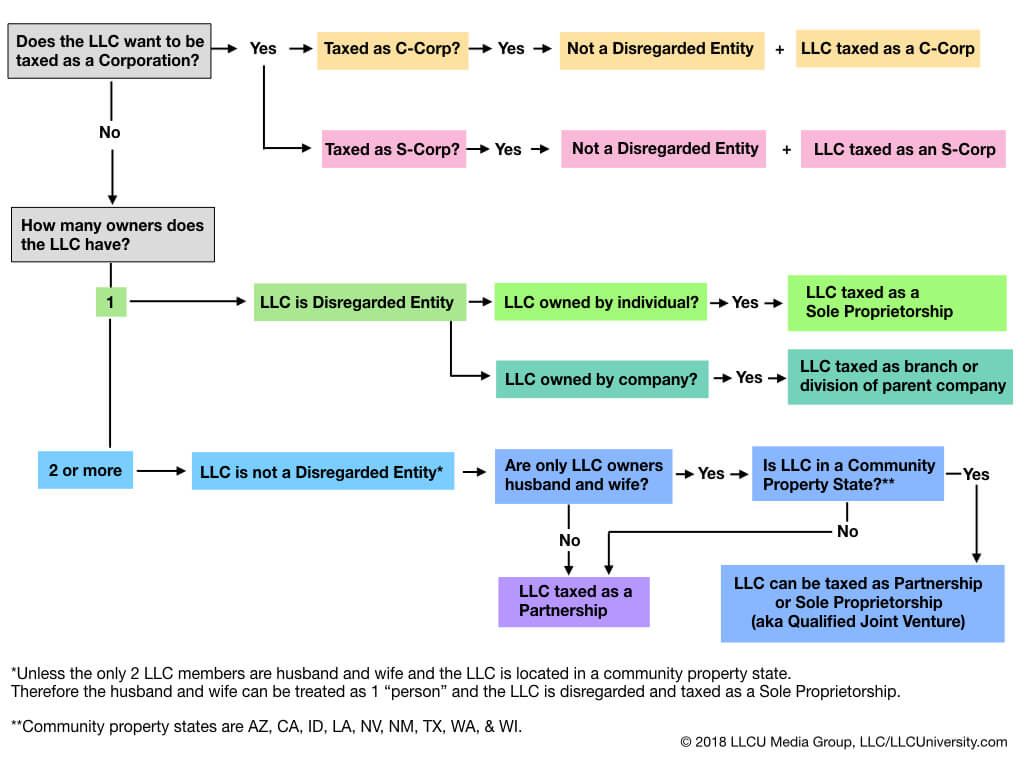

What Is A Disregarded Entity Llc Llc University

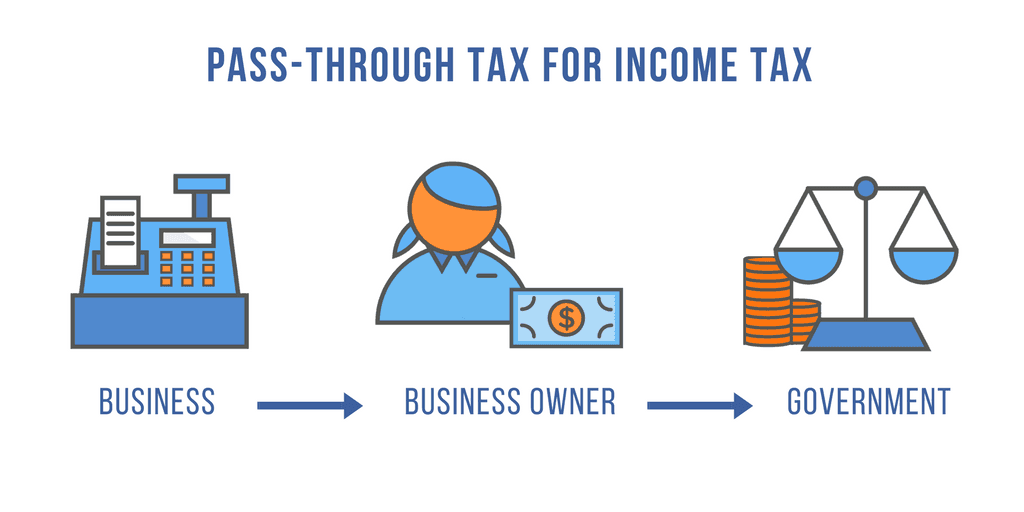

Flow-through entities are also known as pass-through entities or fiscally-transparent entities.

. Theres an annual report to be filed for the entity level tax and its allocation to members on a pro-rata basis this is due by. Report and Pay FTE. So theres some time value of money considerations to be made.

Matt highlights the benefits to corporations or partnerships with pass-through entities and details the tax implications to their members and partners personal returns. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file.

1 2021 the law allows eligible entities to make a valid election and file and pay tax at the entity level giving a deduction against entity taxable income. Retroactive to tax years beginning on or after Jan. The majority of businesses are pass-through entities.

Many flow -through entities are allowed to allocate income to other flow-throughs. More states considering passthrough entity taxes February 2021 IRS allows entity-level taxes as SALT deduction limitation workaround November 2020 California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018. In this legal entity income flows through to the owners of the entity or investors as the case may be.

The Michigan flow-through entity tax is enacted for tax years beginning on and after January 1 2021. Severance Tax Contact Information. Any flow-through entity making a 2021 election after the due date of the flow-through entity tax annual return March 31 2022 for calendar year filers.

In this recorded webinar Maner Costerisans tax expert Matt Latham Partner overviews the states new flow-through entity law. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually.

Then receive a larger refund at the individual level when you file your taxes. Miscellaneous Taxes and Fees. In December 2021 Michigan amended the Income Tax Act to enact a flow-through entity tax.

Per the MI website this tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of the entity to claim a refundable tax credit equal to the tax previously paid on that income. Owners can claim a refundable tax credit against the flow-through. Flow-through entities and their owners should evaluate the tax benefits of making the election and keep in mind deadlines for electing to pay the tax and applicable filing requirements.

That is the income of the entity is treated as the income of the investors or owners. 6 Members of the entity. The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations.

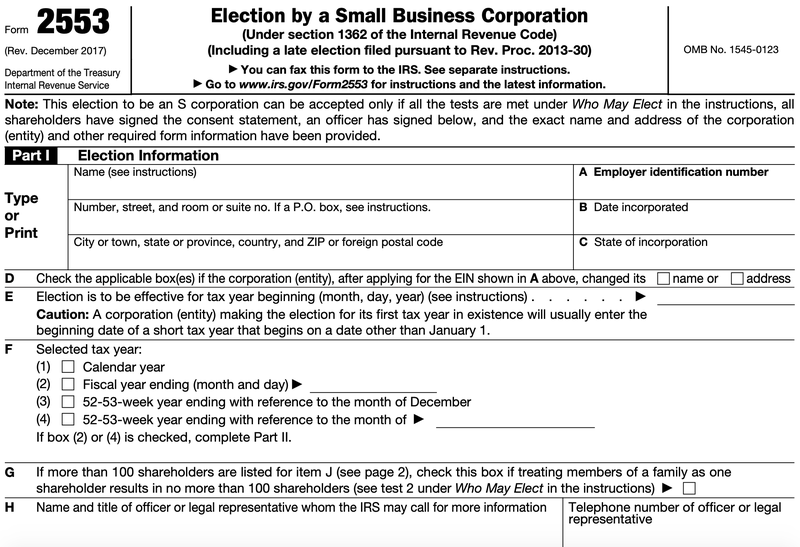

The timely payment of the flow-through entity tax creates a refundable income tax credit and other adjustments that are passed. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Figures Needed for FTE Reporting.

Estates and trusts are required to report their share of tax to their beneficiaries. While there will be some administrative burden in making the election the Michigan Chamber of Commerce estimates that the flow-through entity tax will save. 5 In general an FTE may elect to pay tax on certain income at the individual income tax rate.

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. Effective for tax years beginning on or after January 1 2021 the Michigan flow-through entity tax enacted under 2021 PA 135 levies an elective income tax on flow-through entities with business activity in Michigan. The following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan.

If this flow-through entity election is made youd pay tax at the entity level during the course of the year. When they do the result is a structure with multiple layers. Common Types of Pass-Through Entities.

Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. Hence the income of the entity is the same at the income of the owners or investors. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated payments due for tax year 2021. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. A flow-through can elect to file and pay tax on the income attributable to owners that are individuals estates trusts and eligible flow-through entities.

Understanding What a Flow-Through Entity Is. Limited liability companies LLCs that file federal income tax returns as partnerships Partnerships including limited partnerships limited liability. Flow-through entities are considered to be pass-through entities.

Miscellaneous Taxes and Fees. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. One particular flow-through compliance concern is the existence of complex structures of related entities.

Flow-throughs are also a growing tax compliance concern. A flow-through entity is a legal entity where income flows through to investors or owners. In the end the purpose of flow-through entities is the same as that.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. 1 2021 contingent upon the existence of the TCJA SALT deduction limitation the legislation creates an elective tax on FTEs with business activity in Michigan.

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

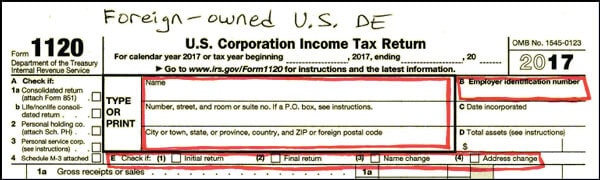

Form 5472 Foreign Owned Us Single Member Llcs Llc Univeristy

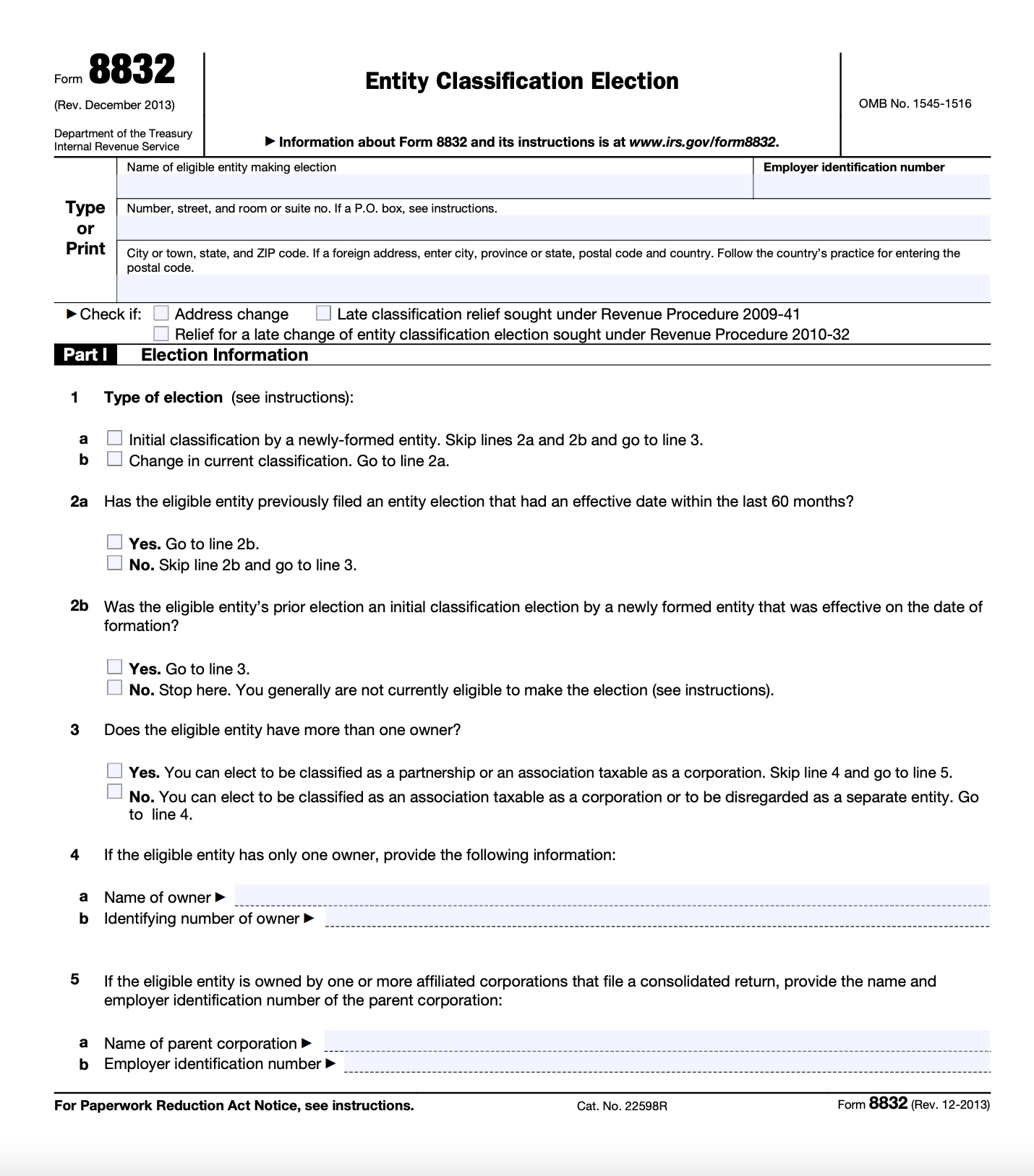

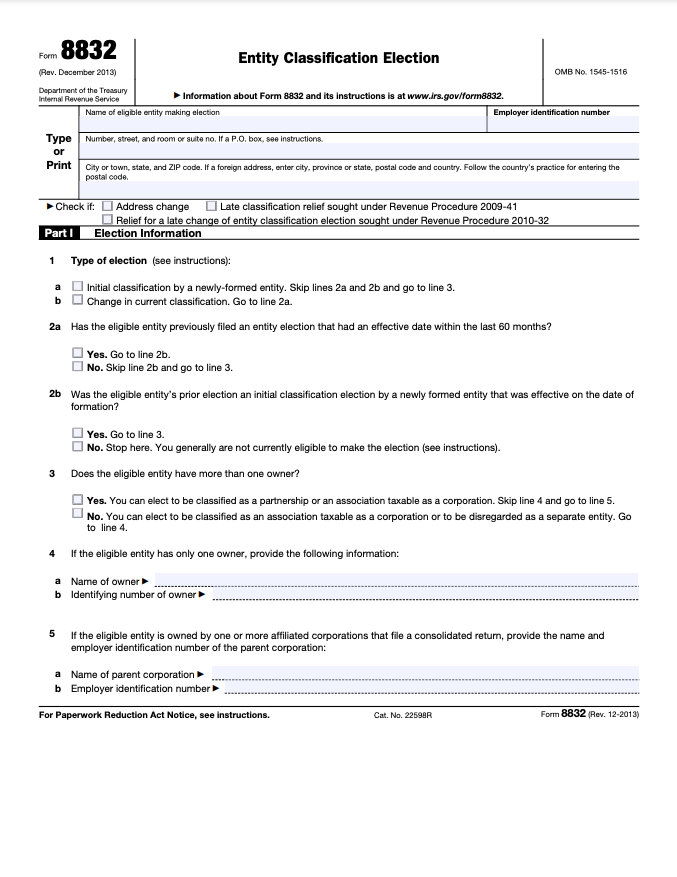

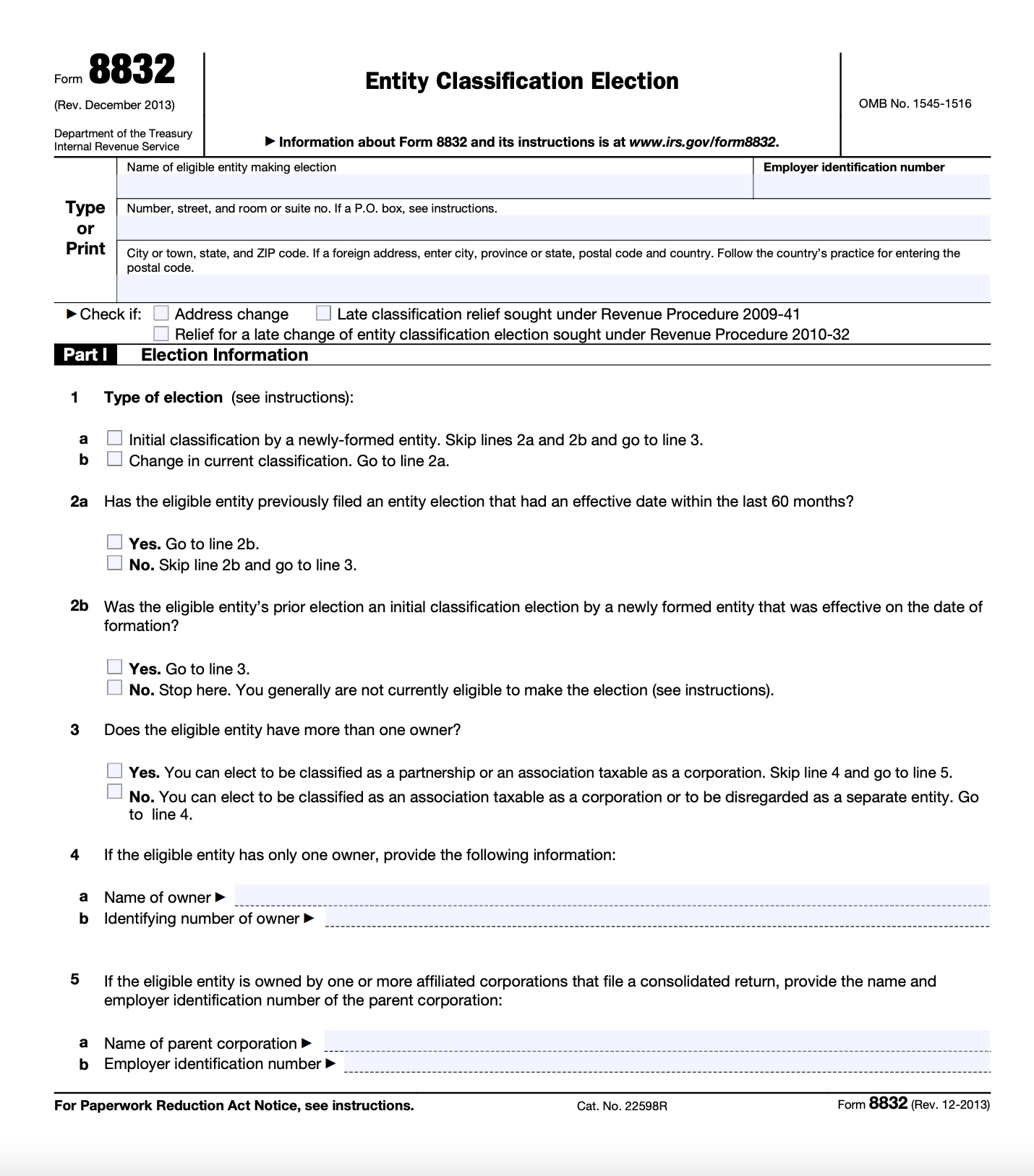

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Pass Through Taxation What Small Business Owners Need To Know

Instructions For Form 5471 01 2022 Internal Revenue Service

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

Instructions For Form 5471 01 2022 Internal Revenue Service

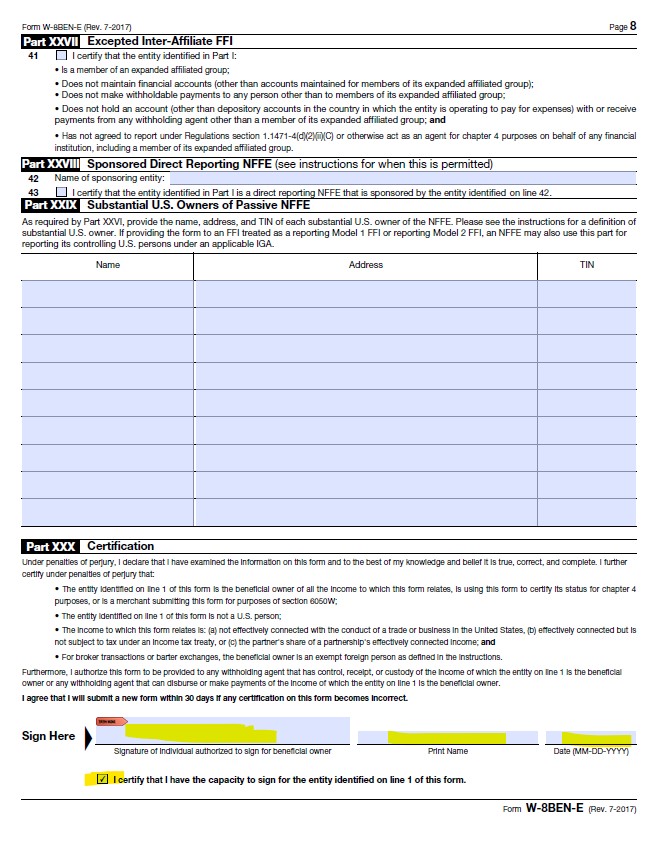

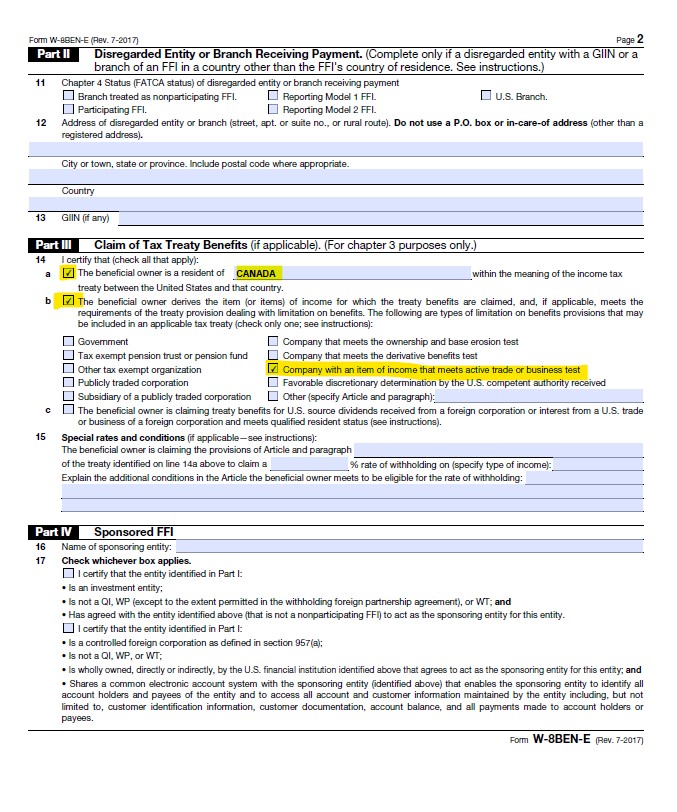

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Instructions For Form 5471 01 2022 Internal Revenue Service

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

A Beginner S Guide To Pass Through Entities The Blueprint

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Form 8832 How To File The Forms Square

Irs Form 945 How To Fill Out Irs Form 945 Gusto

What Is A Disregarded Entity And How Are They Taxed Ask Gusto